Is anyone surprised that the U.S. Federal Reserve cut interest rates by half a percent on September 18? In a Reuters poll, only nine of 101 respondents expected a drop of 50 points (0.5%) from the 5.5%. The U.S. election is just over six weeks away, so I suppose it's just a coincidence. Economists are expecting another rate drop before the election. Jerome Powell, head of the Fed, said, "The U.S. economy is in good shape." That may be news to a lot of people.

There's a claim that inflation is under control, sitting comfortably at 2.5%. But can we really buy into that? Have these people been out shopping lately or seen the insurance rate increases? It's the same story in Australia, where we're told we have a 3.5% inflation rate. Yet house prices are still soaring to record levels and insurance on two of our vehicles has shot up by 30% this year; same cars, just a year older.

The Fed's actions remind me of a bipolar patient fluctuating between the mania of low interest rates and the depression of high interest rates. Why can't they keep things on a more even keel if they are stewards of monetary policy? Of course, the problem is high government spending causing cheap money, and the Fed printing money to accommodate the government.

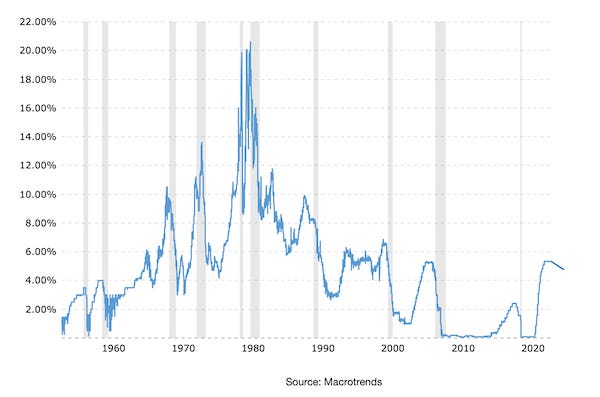

The movement of rates looks like an up-and-down yo-yo. Rates get lower, and then people borrow more, spending more, which drives up prices and wages. Then we get a bubble, either in real estate, the stock market, or both. When rates are driven up by the Fed, the economy stagnates or goes into recession, and interest rates start to drop. The Fed has manipulated monetary policy since the early 1930s. It's not a true free market.

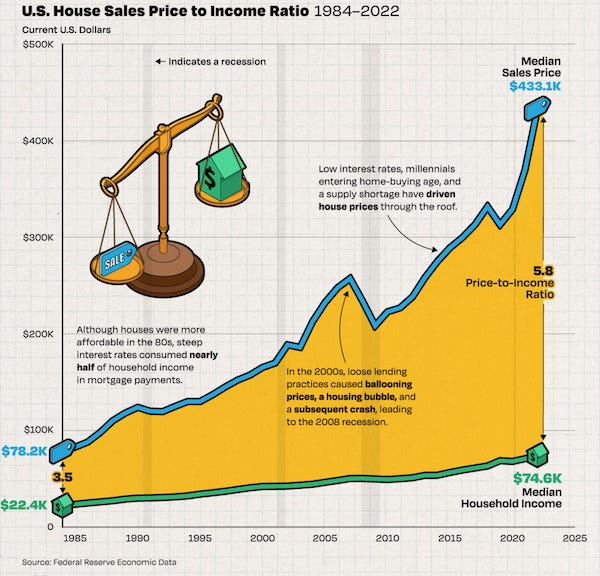

The chart above shows where rates peaked in 1979-80. The rates hit 20%, whereas today, we believe they have been high at 5.5%, with mortgage rates around 7%. So why are things so tough? Well, perception is everything. We've had several years of near-zero interest rates, so a 5.5% rate is a dramatic increase by comparison. However, there is something else at work. The disparity between income and house prices is the key to understanding why people are hurting.

Visual capitalist has produced a colorful graph relating income to house prices.

While mortgages were much higher in 1980 than today, the affordability factor and other inflationary pressures have ensured that people today feel it just as hard.

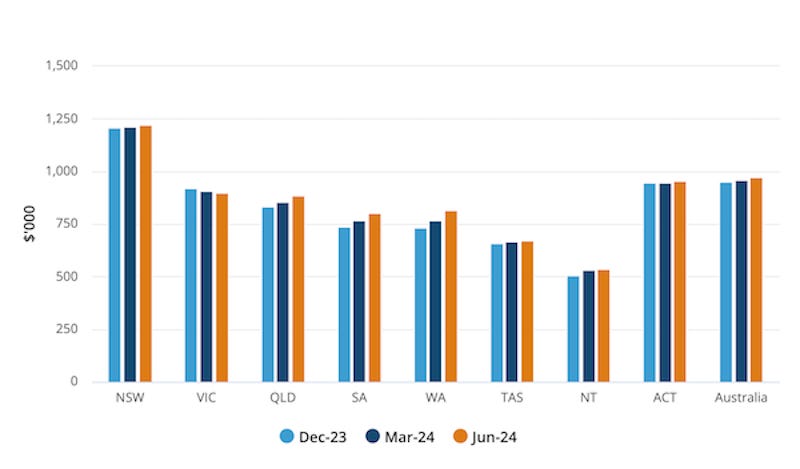

In Australia, it's a similar story, but worse. According to the Australian Bureau of Statistics, the mean house price across all Australian states is $973,300, equating to $661,844 U.S. In Sydney, the largest city, it's $1.8 million.

In Australia, the average annual income is $99,996, which is $67,997 U.S. dollars. Remember, the price-to-income housing ratio today for the U.S. is 5.8 times. In Australia, it is 9.7 times. So, Australia is 67% worse off in housing affordability than the U.S.

I said for several years that the Fed and the Australian Reserve Bank were making mistakes keeping interest rates so low for so long. It lulled people into cheap money. Then, with Covid, governments shut down economies ––a big mistake on many fronts. Then, from March 2022, interest rates started to take off, and in 15 months, they increased by 5.5%. That was a kick in the gut for many people. While 5.5% is not that high, the perception of people used to rates hovering around 0% was staggering.

The boomerang in interest rates means the Fed behaves like a bipolar person. It causes people to follow along and react accordingly. Interest rates go up, shares drop, house affordability drops, and people get negative, and they even start selling assets. When rates go low, people think happy days are here again and so invest, often recklessly.

Are things likely to get better under a Harris presidency? I doubt it. While Harris is demonstrably inept, the left wing of the party will ensure that they tax and spend.

The thing to do is manage your emotions despite the Fed's or the government's unpredictability. Don't be a manic-depressive when

Thanks again Ely for all you extra efforts to find the truth. xxj